|

Getting your Trinity Audio player ready...

|

US-Flagged Panamax Boxship Faces $1.7M Shanghai Port Fee as China’s Levies Take Effect

A US-flagged Panamax containership, the Matson Waikiki, has become one of the first vessels hit by China’s new port fee regime, paying a massive $1.7 million (RMB 12.1 million) to dock in Shanghai. The fee highlights the financial strain and growing uncertainty facing global sea freight operations following the simultaneous introduction of reciprocal port fees by both Washington and Beijing this week.

China’s New Port Fee Policy in Action

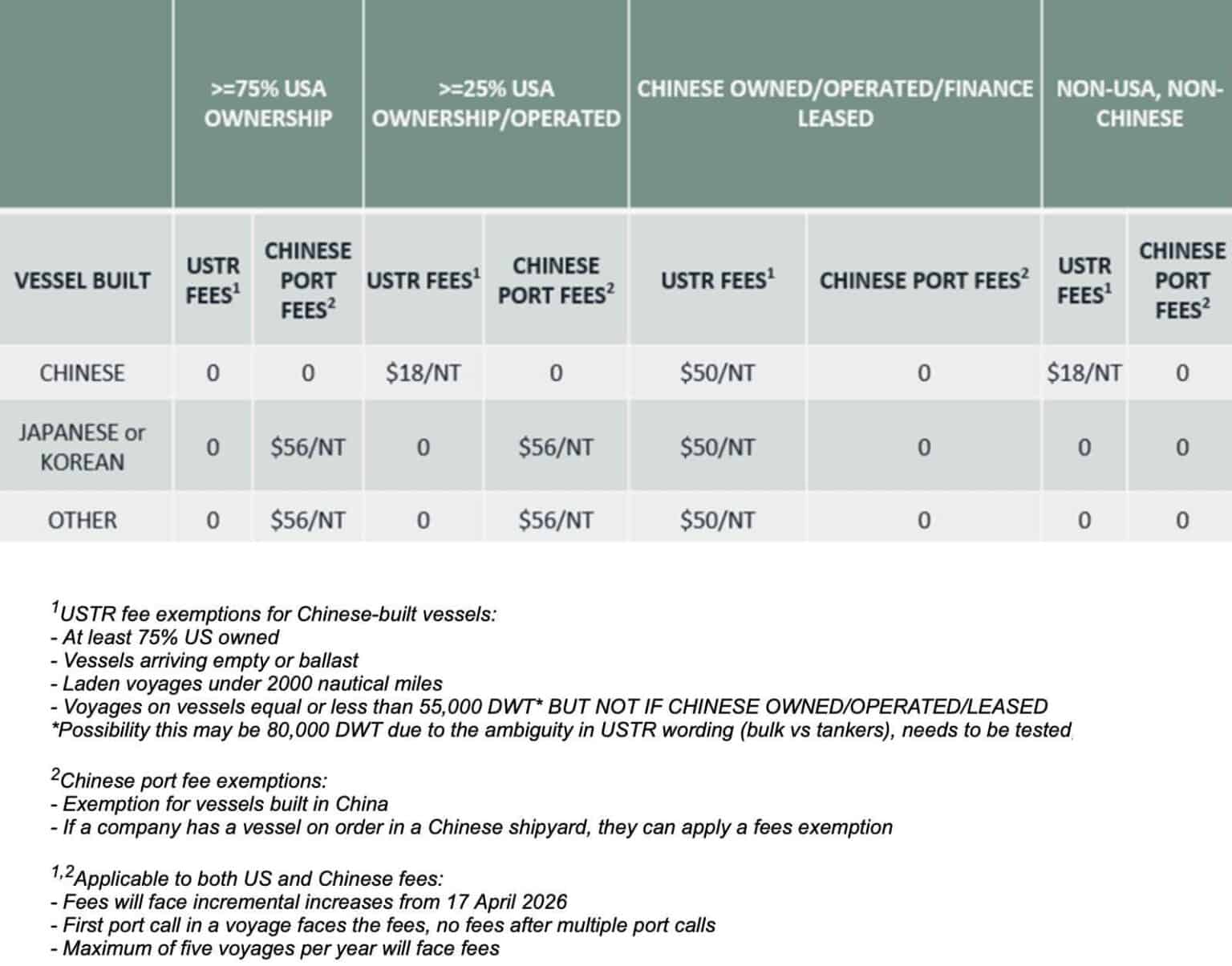

The 4,870 TEU vessel, owned by a German company and operated under the US flag, was charged $56 per net ton under China’s new system, which mirrors the $50 per ton fee imposed by the United States on Chinese-linked tonnage. According to China’s Maritime Safety Administration (MSA), the port levy applies to every vessel’s first Chinese port of call, where details such as ownership, flag, and management are verified through the US-Linked Vessel Information Report Form on China’s National Single Window digital platform.

Beijing’s regulation exempts Chinese-built vessels and empty ships entering shipyards for repair, narrowing the number of ships subject to payment. However, its opaque definition of US ownership continues to sow confusion across the industry. Ships with 25% or more US equity, voting rights, or board seats are liable under the new rules — a clause that has already prompted American directors at some shipping companies to step down to avoid exposure.

Industry Reaction and Broader Sea Freight Impact

Shipping analysts warn that this tit-for-tat escalation could reshape global trade flows and freight rates. A weekly report by Allied Shipbroking noted that tanker operators such as Scorpio Tankers, Ardmore Shipping, Teekay, and Torm could be drawn into the net, given their US stock exchange listings and partial American ownership.

The fees could also distort fleet deployment strategies, forcing owners to reassign vessels based on flag and ownership structure to minimize exposure — a process that adds inefficiencies and costs to already strained sea freight networks.

Greek broker Xclusiv Shipbrokers described the situation as a “spiral of maritime taxation” between the two superpowers, warning that it risks distorting global shipping economics.

“The weaponization of trade and environmental policy signals that shipping has moved from being a neutral conduit of global commerce to a direct instrument of statecraft,” Xclusiv stated. “For owners and charterers alike, navigating this new regulatory battlefield may soon prove as complex — and as costly — as crossing any ocean.”

Outlook for Global Shipping

Market observers expect the US-China port fee standoff to add volatility to tanker, bulk, and container freight markets in the coming months. While some shipowners may find ways to adapt through fleet reshuffling, the introduction of dual port taxation threatens to undermine the cost-efficiency and neutrality that define international sea freight logistics.

The Matson Waikiki, after completing operations in Shanghai, is now bound for Long Beach, California, underscoring the interconnected nature of Pacific trade routes that remain at the heart of this growing maritime policy conflict.