|

Getting your Trinity Audio player ready...

|

ClarkSea Index surges past $30,000 as port fees ripple through markets

The ClarkSea Index, a benchmark that tracks earnings across the global sea freight and shipping industry, has surged above $30,000 per day for the first time since 2022. The jump follows the introduction of reciprocal port fees by the United States and China, which have disrupted trade flows, boosted freight rates, and reshaped charter preferences across major shipping segments.

Port Fee Tensions Drive Market Rally

The index — compiled by Clarksons Research and reflecting daily earnings across tankers, bulk carriers, containerships, and gas carriers — climbed 5% week-on-week to reach $30,461 per day on Friday, more than 50% above its 10-year average.

Analysts attribute the surge to the tit-for-tat port fee measures launched last Tuesday, when both Washington and Beijing imposed new levies on each other’s ships. The sudden rise in operating costs has led to short-term fleet realignments, tighter vessel supply, and elevated charter rates across nearly all sea freight markets.

Tankers and Containers Lead the Gains

In the crude tanker sector, average VLCC earnings jumped 10% to $90,000 per day, while MR tanker rates soared 44% to $25,000 per day — their highest levels in months.

Meanwhile, container freight markets also rallied, led by general rate increases on transpacific routes and capacity tightening through blank sailings. The Shanghai Containerized Freight Index (SCFI) rose 13% week-on-week, reaching 1,310 points, marking one of the strongest performances in recent quarters.

The ripple effects from the port fee standoff have injected volatility into global sea freight pricing, as operators scramble to rebalance fleets and avoid vessels facing surcharge exposure in Chinese or US ports.

Details of China’s Port Fee Implementation

China officially began collecting a special port fee of RMB 400 ($56) per net ton from US-owned, operated, built, or flagged vessels last Tuesday. However, the Maritime Safety Administration (MSA) confirmed that Chinese-built vessels and empty ships entering Chinese shipyards for repairs are exempt.

The new levy mirrors Washington’s earlier fee — $50 per ton — targeting Chinese-linked tonnage, both of which took effect on the same day.

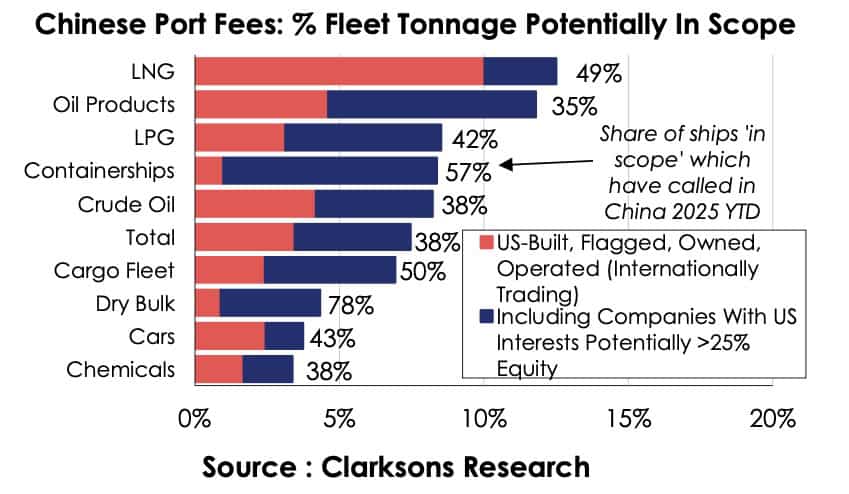

According to Clarksons Research, between 2% and 7% of global cargo tonnage (or 1% to 3% of vessels by number) could be directly affected. The firm noted that while most operators can manage exposure by redeploying vessels, the measures have introduced short-term inefficiencies and charter rate premiums, which could remain “overall supportive” in a tight market.

China Calls for Maritime Cooperation

Over the weekend, China’s Minister of Transport, Liu Wei, addressed the issue during the North Bund Summit in Shanghai, calling on global shipping stakeholders to resist protectionism and maintain free and open sea trade.

“All companies involved in shipping should work together to promote a fair, just, and open environment that safeguards global economic and trade interests,” Liu said.

“We will continue to uphold mutual understanding and shared benefits to build a new ecosystem for sustainable global shipping.”

Liu’s remarks signal Beijing’s attempt to position itself as a champion of open maritime trade, even as its port fee policy adds new layers of complexity to international sea freight operations.