|

Getting your Trinity Audio player ready...

|

Global Box Handling Capacity Set for Biggest Annual Rise Since Financial Crisis

Worldwide container handling capacity is forecast to record its largest annual increase since the global financial crisis, according to the latest Global Container Terminal Operators Annual Review and Forecast published by UK consultancy Drewry.

PSA International Retains Top Global Ranking

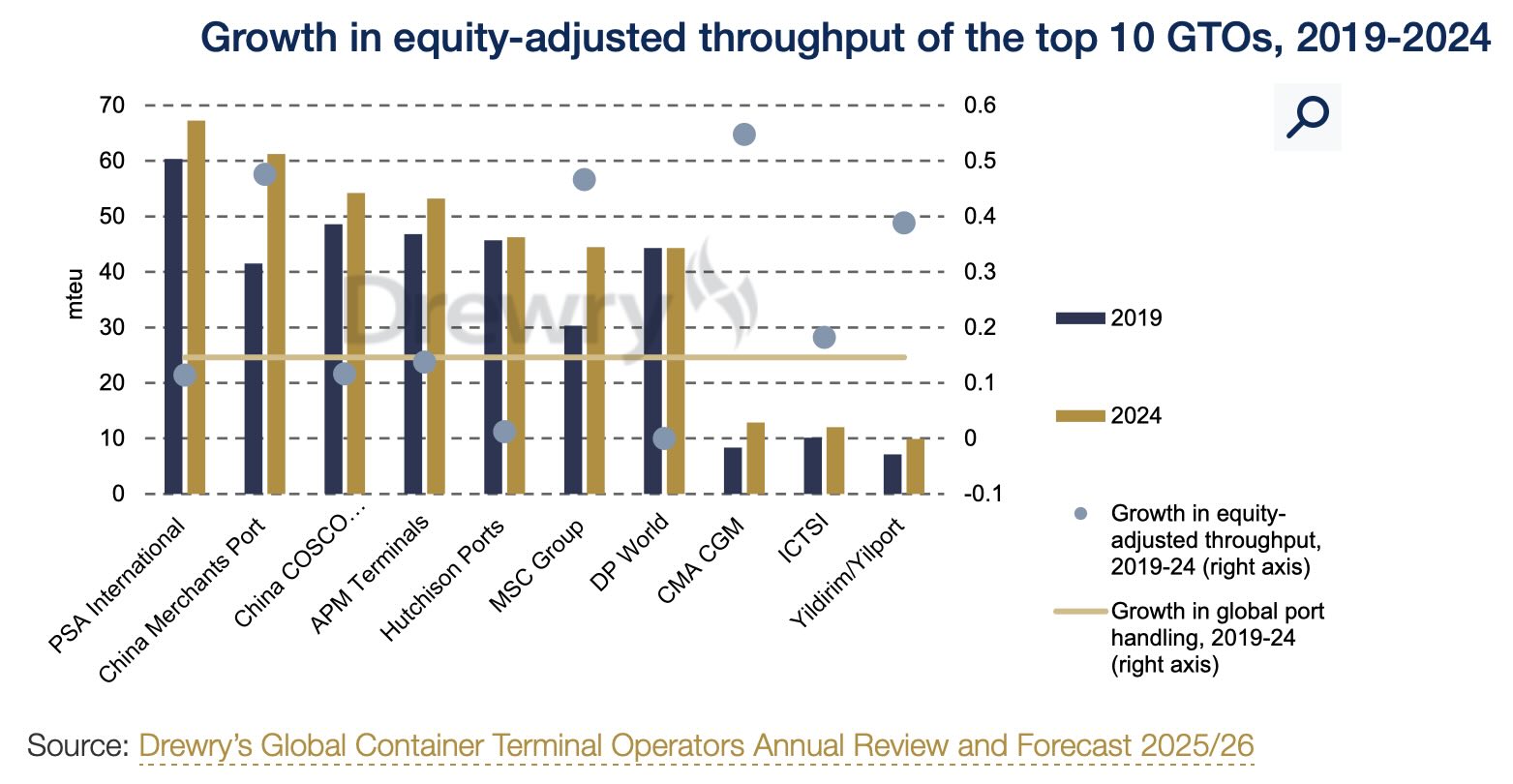

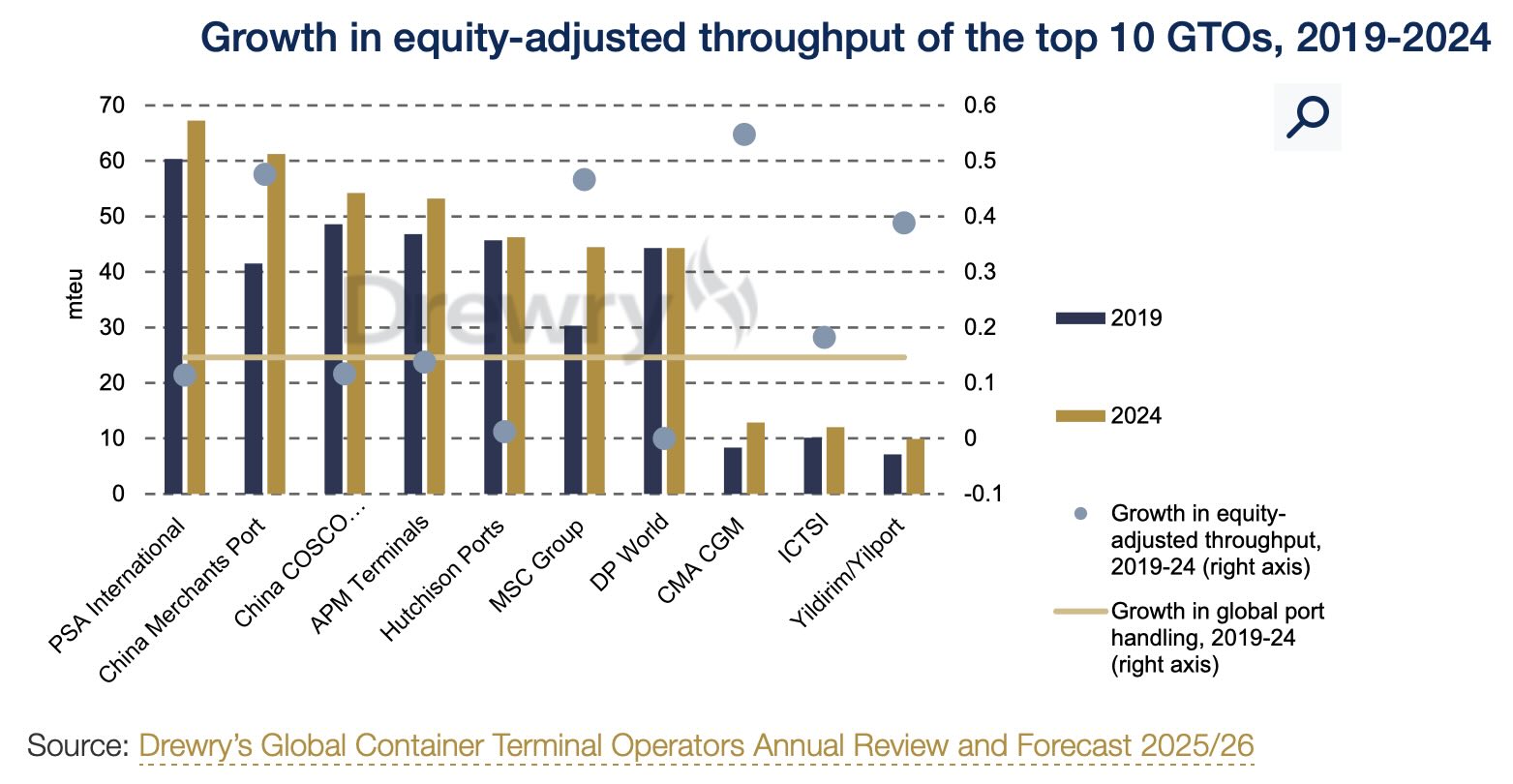

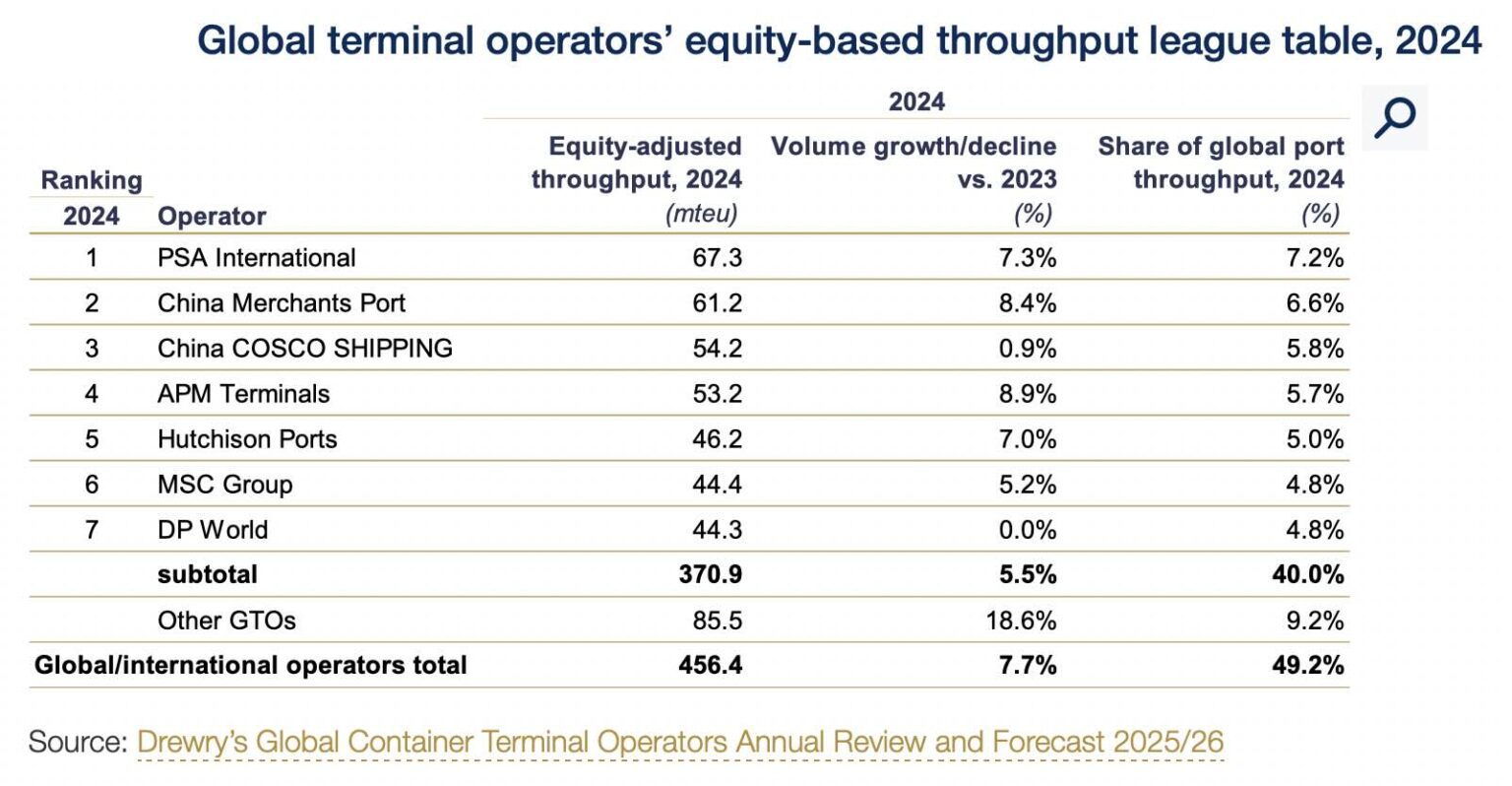

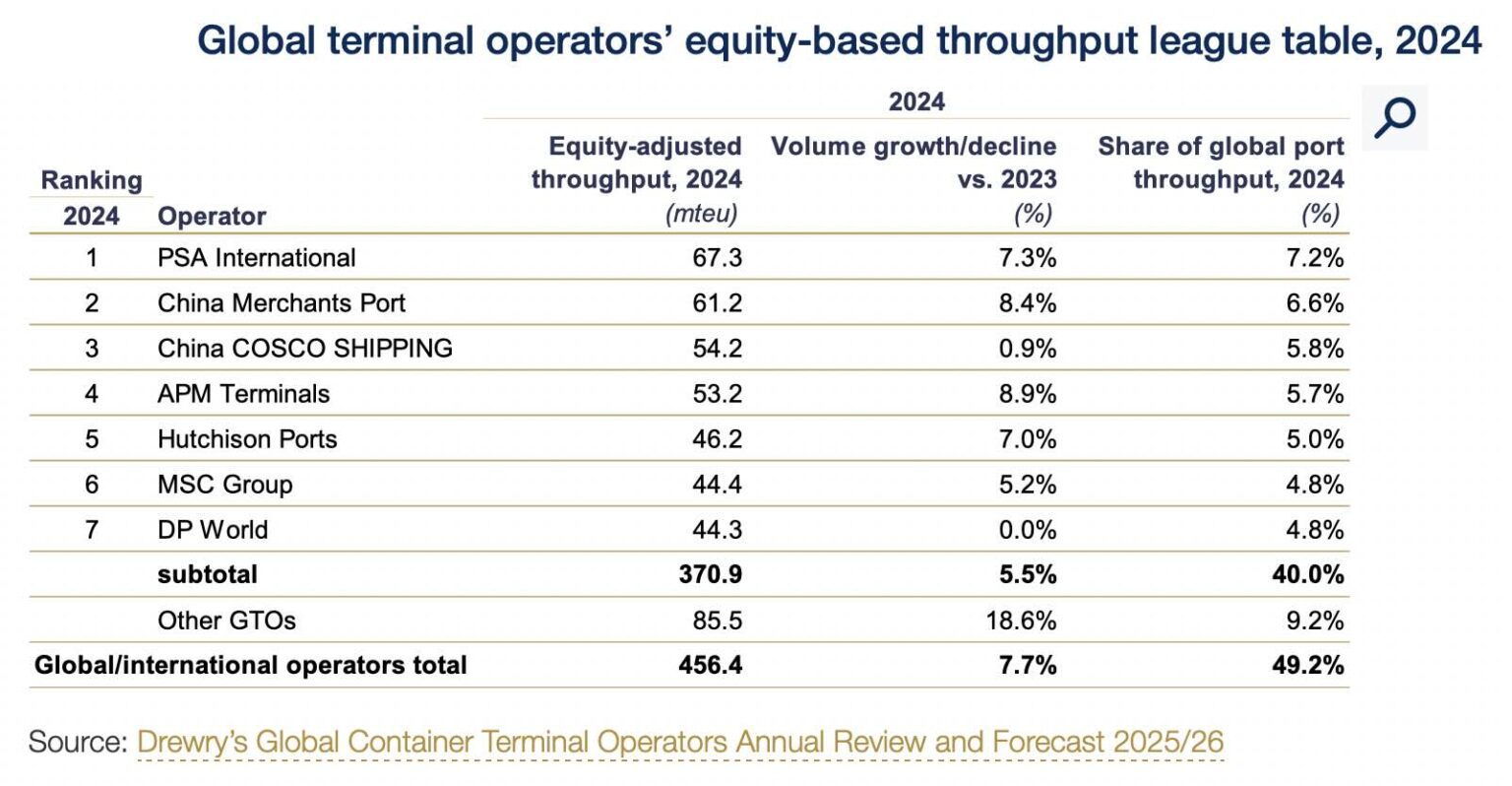

PSA International continues to lead the world as the largest global terminal operator, maintaining the top spot in equity-adjusted rankings with an equity-adjusted throughput of 67.2 million TEU, up 7.3% year on year. Chinese state-backed giants China Merchants and COSCO Shipping Ports secured the second and third positions on Drewry’s podium, reflecting their continued expansion in key maritime hubs.

Carrier-Linked Operators Strengthen Their Positions

The terminal operating arms of several cash-rich global carriers—including MSC, CMA CGM, and Hapag-Lloyd—also advanced in the annual rankings. These companies have leveraged strong balance sheets to acquire and expand terminal assets, using M&A-led strategies to penetrate established port markets where greenfield development opportunities are limited.

“These operators have really pushed forward with M&A-led expansion strategies, which is often the only means of entry into established port markets,”

explained Eleanor Hadland, Drewry’s senior analyst for ports and terminals and the author of the report.

Record Capacity Growth Forecast for 2025

Drewry projects that global container handling capacity will rise by 4.8%, equivalent to 64 million TEU in 2025. This will mark the largest annual increase in absolute terms since the global financial crisis of 2008–2009.

Hadland noted that the forecast reflects buoyant post-pandemic market conditions. The immediate aftermath of the COVID-19 pandemic saw widespread port and terminal congestion, which triggered a wave of terminal upgrades and expansion projects. These investments are now coming online, driving capacity growth at a pace not seen in over a decade.

Implications for Global Sea Freight

The surge in container terminal capacity is expected to enhance efficiency and resilience across international sea freight networks, potentially easing congestion pressures on key trade lanes while intensifying competition among terminal operators. This expansion also provides global carriers with new opportunities to secure strategic berths and improve service reliability amid fluctuating cargo volumes.