|

Getting your Trinity Audio player ready...

|

Port fees become the new tariffs in US-China maritime showdown

The long-simmering US-China maritime confrontation has entered a new phase, as China officially began collecting port fees on US-linked vessels this week — a retaliatory move against Washington’s similar levies targeting Chinese-built or operated ships.

Effective Tuesday, China’s Maritime Safety Administration (MSA) announced that US-owned, operated, flagged, or built vessels calling at Chinese ports will now face “special port fees.” However, Beijing clarified that Chinese-built ships and empty vessels entering for repairs are exempt, in what appears to be a last-minute adjustment aimed at softening the blow to its own shipyards and trade flow.

China’s Countermeasure and Port Fee Mechanics

The MSA will apply the new charges upon a vessel’s first Chinese port of call, using ownership and operational data submitted via the US-Linked Vessel Information Report Form through the China National Single Window platform.

Shipping analysts note that Beijing’s decision to exempt Chinese-built tonnage will likely reduce the overall impact, especially on dry bulk sea freight operators. A research note from broker Arrow said the change “significantly narrows the scope of vessels affected” and suggests that the market disruption may be smaller than initially feared.

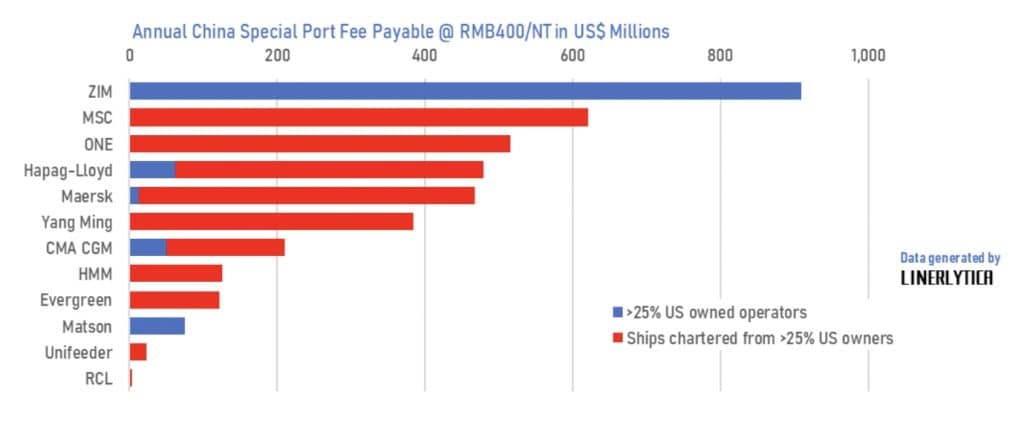

However, the policy’s opaque US ownership rule has already created tension. Ships with 25% or more US equity, voting rights, or board representation fall under the levy’s scope. This definition has triggered governance changes across several shipping firms, with US board members resigning to limit exposure.

“Extending the definition to cover board seats and financial ownership could capture many listed companies,” said Dr. Roar Adland, head of research at SSY, warning that shares held through US mutual funds or investment banks could inadvertently expose numerous global fleets to the new taxes.

Industry Impact: Containers, Tankers, and Sea Freight

In the container shipping sector, New York-listed ZIM is expected to be among the hardest hit, according to Linerlytica. The Israeli carrier will likely face a “double penalty” — paying both the new Chinese port fees and elevated US levies.

In the tanker and bulk markets, analysts at SEB estimate that the larger vessel segments will feel the most pressure. About 65% of China’s total bulk imports arrive aboard Capesize vessels or larger, while 83% of crude oil imports are carried by VLCCs. Of those fleets, 43% of Capes and 29% of VLCCs are Chinese-built, and thus exempt.

SEB noted that China’s policy revisions will allow shipowners to reshuffle fleets based on build origin, minimizing exposure.

“This adjustment should limit disruption, though inefficiencies will persist — already reflected in the rise of both Capesize and VLCC charter rates,” the bank reported.

Rising Costs and Global Sea Freight Ripple Effects

The imposition of port fees on both sides of the Pacific adds another layer of uncertainty to global sea freight and logistics networks. Shipowners are already grappling with rising operational costs, rerouting challenges, and longer waiting times as they navigate evolving regulatory and geopolitical risks.

With US President Donald Trump hinting at 100% tariffs on Chinese goods next month, and threatening sanctions against countries supporting the IMO Net-Zero Framework, analysts warn that the maritime sector is being pulled into a broader trade and environmental policy war.

Shipping Becomes a Tool of Statecraft

According to a report by Xclusiv Shipbrokers, the tit-for-tat port fees have transformed shipping into a “maritime tax battlefield.”

“The weaponization of trade and environmental policy shows that shipping is no longer a neutral conduit of commerce — it’s now a direct instrument of statecraft,” the report stated. “For shipowners and charterers, navigating this new geopolitical reality may soon prove as complex and costly as crossing any ocean.”

This evolving standoff underscores a fundamental shift: sea freight, once a symbol of global cooperation, has become a strategic lever in economic diplomacy, reshaping trade routes, pricing structures, and global cargo patterns.